by Christopher S. Musuneggi, CFS, RFC

President, The Musuneggi Financial Group

Securities offered through Grove Point Investments, LLC, member FINRA/SIPC. Investment Advisory Services offered through Grove Point Advisors, LLC. Grove Point Investments, LLC & Grove Point Advisors, LLC are subsidiaries of Grove Point Financial, LLC. The Musuneggi Financial Group, LLC is not affiliated with Grove Point Financial, LLC or its subsidiaries.

Getting Started

Your Investing Goals

Whether you’re working with an advisor or managing your own portfolio, the first question is always the same: What are you saving for?

- Retirement

- College funding

- Emergencies

- Major purchases

- House

- Wedding

- Dream vacation

Saving for retirement might be the most important thing you ever do with your money. And the earlier you begin, the less money it will take!

Saving enough for college might seem impossible. But families like yours are doing it every day, and it’s easy for you to start too.

Emergency Funds are important to have. Being prepared for life’s surprises can take a burden off your mind—and someday, your wallet.

A house, a wedding, a dream vacation: Don’t forget to plan and save for the big moments in your life!

Retirement

Retirement

When it comes to preparing for retirement, there are a lot of things you can’t control—the future of Social Security, tax rates, and inflation, for example. But one big thing that you can control is the amount you save.

The earlier you start saving for retirement, the less you’ll need to put away each year. That’s why the best time is now.

How much am I going to need?

That depends on many things, including your lifestyle, your retirement age, and your other sources of retirement income.

What type of account should I use for my retirement savings?

Many people have access to workplace plans (401(k)s, for example) as well as IRAs and general savings accounts.

How much do I need to know about investing to manage my savings?

It’s good to have some basic investing knowledge.

How much am I going to need?

You don’t need very much to get started, and the total amount you save completely depends on your family’s goals and resources. It’s something you can think about either now or as college approaches—but in the end, it’s probably not as much as you think.

College

College

When it comes to saving for college, there are a lot of myths out there. What’s true? What’s false? We have the answers.

Only rich people can save for college.

False. About half of all American families are currently saving for college. And you don’t need a lot of money to get started. The most important thing you can do right now is to take the same first step they did: Open an account.

Scholarships or financial aid will pay for college.

Most likely false. Getting a full scholarship or enough financial aid to cover the whole cost of college is unlikely. Only a small percentage of students have their entire tuition covered, let alone housing, books, and fees. (And, in case you were wondering, an even smaller number of students pay for college by winning the lottery.)

I can start saving no matter how old my kid is.

True. It’s never too late to start saving for college. The more you save now, the less you’ll have to borrow. So if your child is in high school, don’t let that stop you.

I’ll lose the money if I don’t use it for college.

False. Even if you save in a type of account that’s specifically meant for college, you can use the money to pay for many trade and vocational school expenses. Or you can give the money to someone else (a qualified family member) to use for college or even graduate school. Even the least flexible account types will give you your money back for whatever reason, no questions asked, although you may have to pay taxes or penalties on any amount your account has earned (but not on your contributions).*

I’ll miss out on financial aid if I save for college.

False. The amount you’ve saved for college or any other goal has much less of an impact on your financial aid than your overall income does. In other words: If your income is high enough, you’ll be expected to pay for at least part of your kid’s college expenses, whether you bothered to save anything or not.

Emergency Fund

Emergency Fund

Emergencies—from a broken bone to a layoff—are a fact of life. When you’re faced with life’s unexpected events, you can be ready. What are emergency funds for?

An emergency fund is a stash of money set aside to cover the financial surprises life throws your way. These unexpected events can be stressful and costly.

Here are some of the top emergencies people face:

- Job loss.

- Medical or dental emergency.

- Unexpected home repairs.

- Car troubles.

- Unplanned travel expenses.

Aside from financial stability, there are other pros to having an emergency reserve of cash.

It helps keep your stress level down.

It’s no surprise that when life presents an emergency, it threatens your financial well-being and causes stress. If you’re living without a safety net, you’re living on the “financial” edge—hoping to get by without running into a crisis.

Being prepared with an emergency fund gives you confidence that you can tackle any of life’s unexpected events without adding money worries to your list.

It keeps you from spending on a whim.

You’ve heard the saying “out of sight, out of mind.” That’s the best way to store your emergency money. If the cash is only as far away as your closest debit card, you may be tempted to use it for something frivolous like a designer cocktail dress or big-screen TV—not exactly an emergency.

Keeping the money out of your immediate reach means you can’t spend it on a whim, no matter how much you’d like to.

And by putting it in a separate account, you’ll know exactly how much you have—and how much you may still need to save.

It keeps you from making bad financial decisions.

There may be other ways you can quickly access cash, like borrowing, but at what cost? Interest, fees, and penalties are just some of the drawbacks.

In a nutshell, you should have at least 3 to 6 months’ worth of expenses. We recommend closer to 6.

Major Purchases

Major Purchases

Saving for a big event in your life is exciting! What’s your plan to pursue your goal? How long will it take you to save?

How long it takes depends on what your goal is, how much you need, and how much you can put away every month.

You have options on how to grow your savings, too.

You could just add up whatever’s left over in your bank account after you pay your bills each month.

Why not use a credit card? There are ways around saving for your goal, like using credit cards or borrowing from other savings, but they often come with drawbacks. But putting that money in a separate investment account instead can have major benefits.

You could invest your money. 2 benefits of investing to pursue your goal:

It keeps you from buying something else. No matter how much you really want to check this savings goal off your list, it’s all too easy to spend the money on something else when it’s just sitting in your bank account.

Maybe you think that willpower alone will be enough to keep you on course. If so, that’s great! But what if it doesn’t?

The best way to ensure that your money goes toward your goal is to move it out of your bank account before you’re tempted to spend it. Keeping this money in a separate account also makes it easier to see the progress you’re making toward your goal.

It gives you a chance to potentially reach your goal faster. Let’s say you want to save for a down payment on your first home. You expect to need about $10,000, and you budget $200 a month toward your goal.

Keeping the money in a bank account typically means you’ll earn a pretty low rate of return—0.5%, for example.

At that rate, it will take you a little over 4 years to reach your goal, during which you’ll deposit a total of $9,800.

If you instead invest the money in a moderate-risk investment and earn an average return of 5%, you could reach your goal 4 months earlier—with total deposits of only $9,000.*

*There are risks involved with investing, including possible loss of principal. An example provided herein is hypothetical and not indicative of any particular investment vehicle. It does not reflect the fees and expenses associated with any particular investment. Also, this example does not take into account any state and/or federal taxes that you would owe on your withdrawal. Actual results will vary and fluctuate with market conditions. In addition, rates of return will vary over time, particularly for long-term investments. There is no assurance that any particular strategy will work under all market conditions.

Your Savings Priorities

Now that you know your financial goals, you know that we are talking GoalS…plural. So you also need to figure out how to effectively juggle those goals.

What Comes First?

- Save for retirement

- Pay off debt

- Start emergency fund

- Save for college

- Save for major purchase

If you haven’t started saving for retirement through your employer or on your own, get started on this goal first. Remember, you can’t take out a loan to fund your retirement.

Next, pay off any consumer debt you might have. This type of debt, like credit card balances or car loans, is usually short term and not tax-deductible. It typically carries a high-interest rate as well.

Once you’re saving for retirement and you’ve paid off your high-interest debt, you should put aside money to build an emergency fund to cover at least 3 to 6 months’ worth of living expenses. You don’t want to be caught off guard when something unexpected happens.

If you’ve got kids or other children in your life and you’re planning to support them in continuing their education, this should be next on your list.

Once everything else is off to a good start, begin saving for a major purchase.

Your Budget

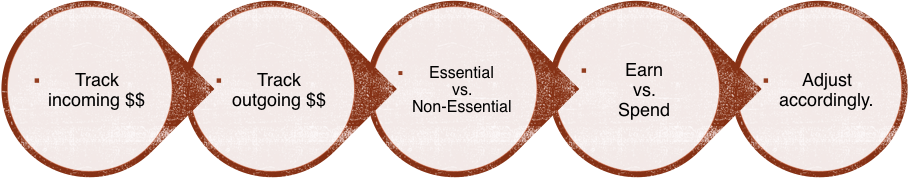

Statistics tells us the leading cause of household stress is money. Yet many people don’t have a system for knowing where their money goes once it comes in the door.

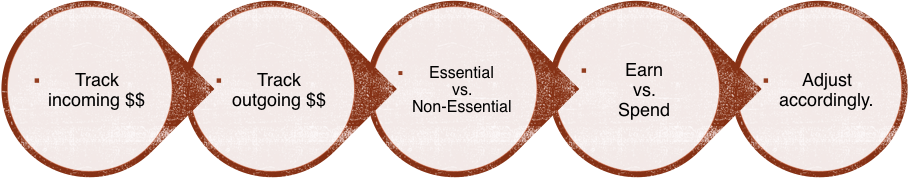

A budget tracks where your money comes from and where it’s going, and this is an important practice for everyone, no matter what your income or goals are. It can be as simple as tracking your money with a basic spreadsheet. Click here to download our basic budgeting tool.

First, you need to know where your money is coming from. What do you earn? Do you have multiple sources of income? Don’t include gifts or bonuses unless you’re certain of them.

Second, know where your money is going. Include every expense and purchase, from your credit cards and student loans to last-minute trips to Trader Joes. Online purchases count here, too.

Once you know where your money is going, study that list a bit. Separate your essential expenses—like rent or mortgage—from non-essentials. Be brutally honest here. Maybe your internet connection is essential, but your Netflix subscription isn’t.

Then you need to add up both columns—income and expenses (include essential and non-essential for now)—and compare.

If you’re spending more than you make, it’s time to look carefully at those non-essentials and cut out what you can.

If your expenses are less than your income…great! You’re in a better position to start saving for those goals we identified earlier. But don’t waste this opportunity by suddenly over-spending. Still look to your non-essentials to see what can be cut; saving more now is a smart strategy, and your future self will thank you!

Thank you!

The Musuneggi Financial Group

www.mfgplanners.com

412-341-2888

info@mfgplanners.com

1910 Cochran Road

Manor Oak Two, Suite 520

Pittsburgh, PA 15220

- Registered Representatives may only conduct securities business with residents of the state(s) and Jurisdiction(s) in which they are properly registered. For additional information, please contact us.

Retirement

Retirement College

College Emergency Fund

Emergency Fund Major Purchases

Major Purchases

The end of the year can help remind us of last-minute things we need to address and long-term goals we want to accomplish. To that end, here are six aspects of your financial life to think about as this year leads into the next.

The end of the year can help remind us of last-minute things we need to address and long-term goals we want to accomplish. To that end, here are six aspects of your financial life to think about as this year leads into the next.  Contact Christine Pikutis-Musuneggi at 412-341-2888 x314, by

Contact Christine Pikutis-Musuneggi at 412-341-2888 x314, by  What do you need to think about? It may be helpful to start with the end – that is, visualize how you see things looking without you in charge. You have an opportunity to guide your company to a potentially lasting legacy, as your staff contends with the changes. If there is a sense of continuity in place, this may allow the transition to progress more efficiently.(1)

What do you need to think about? It may be helpful to start with the end – that is, visualize how you see things looking without you in charge. You have an opportunity to guide your company to a potentially lasting legacy, as your staff contends with the changes. If there is a sense of continuity in place, this may allow the transition to progress more efficiently.(1) If you Have a Mortgage Payment and no House, you may Have Just Graduated from College

If you Have a Mortgage Payment and no House, you may Have Just Graduated from College But Now What?

But Now What?

Having written a book called “A Man Is Not A Plan,” it is an easy transition to say, “A parent is not a plan, a child is not a plan; and neither is your boss, your government, your girlfriend, your spouse, your bartender. No one should be your plan. The plan is YOU.

Having written a book called “A Man Is Not A Plan,” it is an easy transition to say, “A parent is not a plan, a child is not a plan; and neither is your boss, your government, your girlfriend, your spouse, your bartender. No one should be your plan. The plan is YOU. In the lazy days of summer it is a good time to assert your independence by mapping out the plans for your life. That way you don’t need to have a man, a woman, a cousin, as sibling, a parent, a child, a government, or yes…even your bartender be your plan.

In the lazy days of summer it is a good time to assert your independence by mapping out the plans for your life. That way you don’t need to have a man, a woman, a cousin, as sibling, a parent, a child, a government, or yes…even your bartender be your plan.